Frequently asked questions - FAQ

The Indian Mutual Fund Industry has progressed over the years. The Assets Under Management (AUM) of the Indian Mutual Fund Industry have grown from ₹ 5.90 lakh crore as of FY11 to ₹ 31.40 lakh crore as of FY21, more than a 5-fold increase in a span of 10 years (Source: AMFI).

Interestingly, with the increasing inflation, growing aspirations of people and sub-optimal returns offered by traditional investment avenues, investors are gradually shifting their preference to mutual funds to meet their financial goals. There have been around 3.06 crore unique mutual fund investors as of December 2021 (Source: AMFI).

The Indian Mutual Fund Industry offers more than 1500 mutual fund schemes. Investors can select from a slew of funds depending on their investment objective, risk-return appetite and financial needs.

The Mutual Fund AUM to bank deposits (%) as of the end of each fiscal year has increased from 11% in FY11 to 20% in FY21 (Source: AMFI). A shift from other household assets can accelerate the growth of the Indian Mutual Fund Industry and provide distributors with an opportunity to manage larger portfolios for the investors.

As of March 2021, the Investor accounts/population ratio for India stood at 8% (Source: AMFI, Industry research). The value of this measure is relatively lower than countries like the US, China and Japan, which implies that distributors have the potential to cater to a huge base of potential investors in India.

The Indian Mutual Fund Industry is projected to grow sharply in the coming years. While distributors tap the vast potential in the industry, they can leverage the opportunity to expand and attract a higher wallet share. A rise in retail participation and further expansion in mutual fund distribution channels could give growth in the industry a leg-up. Distributors could play a key role in enhancing the growth prospects of the industry with the help of financial awareness programs and cementing a strong relationship with clients.

1) Financialization of savings is gaining traction: Change in savings behaviour is currently an ongoing trend across the country. Mutual Fund Distributors can seize this opportunity and carve a niche for themselves by adapting to the changing customer preferences. Mutual funds provide an opportunity for risk mitigation and potential wealth creation in the long term. Moreover, the industry is well regulated and transparent.

2) Knowledge is the key capital required: Mutual Fund Distributors should have the requisite knowledge of the industry. With the evolving market dynamics, it is crucial to upskill constantly. Becoming a Mutual Funds Distributor requires almost zero investment except for license and certification fee; a digital interface and basic infrastructure to operate are key for functioning.

3) Serve the society: A Mutual Funds Distributor guides investors to ensure that they are on the right track of wealth creation via asset allocation. They educate clients about financial aspects and work towards the financial well-being of their clients, thus helping society to meet its investment goals.

4) Good earning potential: A blend of legacy business, net flows and market appreciation could help the earnings of a distributor advance at a relatively faster rate. Some of the growth drivers are new client acquisition, growth in wallet share with existing clients and market appreciation of the client's investments.

5) You can be your own boss: Mutual Fund Distributors can create their own working style while adapting to changing scenarios. This offers them the flexibility of working and growing at their own pace.

6) Learn for life: Mutual Fund Distributors should possess a future-oriented outlook and keep upgrading themselves. This would help them stay ahead of the learning curve and create value for clients with their expertise.

1) Educate clients about the need to undertake financial planning: Mutual Fund Distributors educate investors about the relevance of financial planning, the asset allocation strategies, the need to diversify an investment portfolio, the structure of mutual funds, the types of schemes, etc.

2) Evaluate the risk appetite of the investor: Mutual Fund Distributors play a crucial role in understanding the risk profile of clients and suggesting an investment strategy based on the risk appetite of the investor. For example, an aggressive investor is willing to take higher risks and will want to invest a larger proportion of the portfolio in equity mutual funds.

3) Research and analyze investment options: Distributors can educate clients about various investment options with a view to maximize the returns and minimize the risks in an investment portfolio. This requires an in-depth analysis on the available investment options and their suitability for clients.

4) Support clients with the execution of transactions: Mutual Fund Distributors communicate to clients about the modes of investment in mutual funds such as Systematic Investment Plan (SIP), Lumpsum investment, Systematic Transfer Plan (STP), Systematic Withdrawal Plan (SWP), which could be selected in line with the financial needs of the investor. Also, they play a key role in supporting the client with the execution of the investment transaction by coordinating with the relevant asset management company for the process.

5) Regularly connect with clients to share updates on the economy: Mutual Fund Distributors should be abreast of developments in the markets, regulatory aspects, and other key macroeconomic factors that could affect the performance of the client's portfolio. They should regularly connect with clients to share relevant updates on the economy.

6) Support clients with portfolio review and rebalancing: During the course of time, there could be deviations in the portfolio of the investor and it may not eventuate as planned. Also, there may be changes in the financial needs of investors. Mutual Fund Distributors should support clients by reviewing their portfolio and rebalancing it on assessment, as the need arises.

7) Undertake behavioural coaching: Distributors guide investors by undertaking behavioural coaching and managing their emotions during phases of market volatility. Distributors act as mentors to ensure that investors focus on achieving their long-term financial goals and do not get swayed by emotions during challenging phases in the market.

Yes. Graduates from any discipline can pursue their career as a Mutual Funds Distributor. This powerful role provides exposure to research, financial markets, economics, behavioural science and financial planning. Also, it gives them an opportunity to make a meaningful impact in the lives of individuals and families across the socio-economic spectrum. While working, they can grow at their own pace and also benefit from a good earning potential.

Individuals from all walks of life such as fresh graduates, women looking to re-enter workforce, retail shop owners, insurance agents and retired professionals can become a Mutual Fund Distributors.

Women can become Mutual Fund Distributors and grow at their own pace. This profession offers the flexibility to manage household responsibilities and parallelly grow the business from home while using digital platforms at their own pace. This opportunity can give them an identity on the professional front, help them become financially secure, offer a greater sense of personal fulfilment and broaden their perspective.

Retail Shop Owners/insurance agents are well-positioned to understand the lifestyle of customers/clients and can guide individuals on their journey to wealth creation as a Mutual Fund Distributor: This opportunity would give them a chance to deepen relationships, tap an additional source of income and experience a sense of satisfaction while channelizing clients to meet their financial goals.

Retired Individuals can also initiate their journey in the Mutual Fund Industry as a distributor: This would give them a sense of purpose and financial security, facilitate interaction with people from varied backgrounds, instill confidence and help plan their 2nd innings.

Individuals who wish to become Mutual Fund Distributors should appear for the 'NISM - Series V-A: Mutual Fund Distribution Exam.'

On clearing the NISM Series V-A: Mutual Fund Distributors Certification Examination', the National Institute of Securities Markets will issue a NISM Certificate. The individual will then have to apply to AMFI for an ARN (AMFI Registration Number) and EUIN (Employee Unique Identification Number), which accredits the individual to sell mutual fund products. The NISM certification is valid for a period of three years from the date of examination.

Distributors can approach asset management companies for empanelment after receiving the ARN number. They would gain information about the empanelment process, documentation requirements and other details on the website of the asset management company.

Asset management companies help distributors with the necessary marketing tools, training material and other guidance required to start their journey as a Mutual Funds Distributor. This would help them to work effectively with clients as they carve their path seamlessly as a distributor.

1) Most of the asset management companies have training verticals, which drive the training needs of the Mutual Fund Distributors: Asset management companies provide training programs on topics such as introduction to financial planning, understanding various asset classes, the concept of mutual funds and their categories, how to analyze the investment, effective sales management process, building relationships with clients, etc.

2) Asset management companies provide Sales enablers like calculators, asset allocation tools, etc. These tools are provided on web portals and mobile apps of the asset management companies.

3) Distributor queries can be solved offline (through RMs/AMC offices/R&T offices) or online (Web Portal, IVR System, Emails, Dedicated Customer Care Numbers): Asset management companies help resolve the queries such as Sales Transactions, brokerage or service related.

AMFI also provides operational and regulatory guidance to distributors. Also, the industry body has promoted awareness about mutual fund products with the help of several initiatives and the 'Mutual Funds Sahi Hai' campaign.

Demonstrating that you have passion, determination, knowledge and adaptability can help scale your business to greater heights. The following are some of the key skills:

1) Forward Thinking: Adapting to a future-oriented outlook would enable distributors to turn challenges into opportunities, strive for continuous learning and development, have a high degree of self-awareness and aspire to differentiate themselves from the competition by providing innovative and value-added solutions.

2) Passion to create value for clients: Distributors who are passionate about the product that they sell and believe in its true value have a greater conviction level. They channelize themselves to create value for clients and are determined to provide effective investment solutions to meet the needs of investors.

3) Persistence to adapt and adopt: With the ever-evolving needs of investors, technological advancement, and changes in the financial landscape, it is imperative for distributors to persistently adapt to the market dynamics and enhance the efficacy of their deliverables.

4) Patience to shift into a growth mindset and aspire to unlock the untapped potential: Distributors with a growth mindset believe that their skills and intelligence can be nurtured over a period of time. They break free from the shackles of fixed beliefs and aspire to unlock their untapped potential.

5) Mindfulness: Observant sales representatives are mindful of their client’s goals, beliefs, values and perspectives. While actively listening to their prospects, they are receptive to the pain points and challenges faced by the clients. Mindfulness could help drive success in sales by adapting to time management techniques, embracing the present and strengthening the ability to pay attention to client interaction as it unfolds.

6) Know your subject matter well: Distributors should know their subject matter well and should also be effective in their communication with clients.

7) Emphasize customer relationships early in the selling process and build pipeline consistently: Developing a rapport with the customers well before the negotiation stage could help distributors cement a strong relationship with their clients and get a leg up on the competition. Successful sales representatives are always looking for potential customers to build their pipeline consistently.

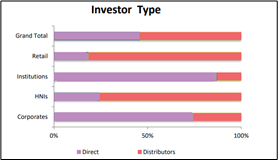

As per the Industry Trends Report of AMFI as of February 2022, an interesting fact is that about 18% of the retail investors chose to invest directly in mutual funds, while 24% of HNI assets were invested directly. This indicates that around 82% of the retail investors decided to invest in mutual funds through distributors!

Over the years, distributors have played a key role in shaping the Mutual Funds Industry and helping investors create wealth in the long term.

The following reasons highlight the importance of distributors in the Mutual Funds Industry despite the introduction of Fintech:

1) Personal interaction with clients: Fintech Platforms enables investors to buy and sell mutual funds online, however, it is bereft of personal human interaction, required while undertaking transactions. Investors may prefer to interact with distributors and understand the specifications of the product before investing their hard-earned money.

2) Distributors help to instill trust and credibility: Distributors interact with clients and cement a long-term relationship with them, which gives investors a feeling of trust and credibility while investing in the product.

3) Educate Clients about the importance of financial planning and address their queries: Investors may not be well-versed with the financial terms, which may dissuade them to invest or shift to domestic means of savings. Distributors address queries of investors related to taxation benefits in mutual funds, accounting, etc.

4) Devise an investment strategy for investors: While leveraging fintech platforms, investors may get overwhelmed with the various schemes available and may not be able to gauge which scheme is suitable for their investment profile. Distributors play a key role in devising an appropriate investment strategy for investors based on their financial needs.

5) Advice investors on mistakes made in the past: Distributors are aware of the common investment mistakes made by investors and they disseminate this knowledge to investors to help them make prudent investment decisions.

6) Give investors peace of mind during market downturns: In case of a market correction, investors may make irrational decisions of liquidating their investments. Distributors guide investors during such challenging market periods and emphasize the importance of staying invested for the long run to benefit from the opportunity of generating better risk-adjusted returns.

In Tier 3 cities, investors may still prefer to invest only in traditional saving schemes and assets such as gold as a result of low levels of financial literacy, short-sighted cultural attitude towards investment, and so on. There is a vast untapped territory in Tier 3 cities that can be tapped for penetration of mutual funds.

Distributors can make an impact by adapting to the following strategies:

1) Financial jargon should be simplified: Investors should be educated about the need to invest in mutual funds and the financial jargon should be simplified. Asset Management Companies and AMFI have devised several campaigns to raise awareness and position mutual funds as a suitable investment option for potential investors.

2) Need to invest in financial products that could help beat inflation in the long run: Distributors can enumerate that traditional savings schemes may be relatively safe investment solutions; however, the returns are sub-optimal and the investors may not be able to meet their financial goals in a dynamic environment.

3) Communicating with the investors in their regional language could help build trust and a better connection.

4) Investors in these cities tend to be conservative and reluctant to take risks: Distributors can bridge the knowledge gap and provide information about myriad mutual fund schemes that investors can cherry-pick from as per their investment profile.

5) Distributors can outline the facets linked to a Systematic Investment Plan: The amount required for investment could be as low as Rs.500 at regular intervals, making it a pocket-friendly and convenient investment tool.

6) Sales enablers like SIP Calculators, Asset Allocation Tools, etc. are provided on web portals and mobile apps of AMCs. These can be leveraged to compute the math with ease.

Relationship managers associated with an AMC are entrusted with the responsibility to upsell Mutual fund products to Retail and HNI Clients and work towards generating leads. They are accountable for profiling and advising investors, thus providing suitable financial products to meet the needs of the customer. They also seek opportunities to collaborate with distributors and deliver cross-selling opportunities. They help distributors expand their client coverage, thus helping clients in their journey of wealth creation.

1) Provide product updates: Relationship managers have the expertise in the product features and mutual fund scheme portfolio. They help partners understand the scheme in terms of the portfolio, associated risk and positioning in the overall investment portfolio of the client. Moreover, they help partners understand which mutual fund scheme has to be sold to which type of clients and in what proportion to optimize the return and manage the risk.

2) Help in understanding market dynamics and scheme suitability: Relationship managers play a key role in communicating market developments to distributors while keeping track of the market trend in relation to the portfolio of the scheme.

3) Simplify product presentations: Relationship managers simplify financial jargon for the distributors and help partners make effective presentations to their clients.

4) Provide end-to-end support to resolve service issues: Relationship managers help distributors in resolving any service-related issue faced by them or their clients.

5) Help with skill development to facilitate business growth: They provide value-added information on aspects such as technical, software, managerial skills, etc. to impact the business growth.

Disclaimer: The information contained in this material is for informational purposes and for creating awareness about Mutual Funds Distribution and there is no guarantee of potential income.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.